Thomas Insurance Advisors Fundamentals Explained

Table of ContentsA Biased View of Thomas Insurance AdvisorsThe 8-Minute Rule for Thomas Insurance AdvisorsMore About Thomas Insurance AdvisorsNot known Incorrect Statements About Thomas Insurance Advisors

Because AD&D just pays under details scenarios, it's not an appropriate alternative to life insurance policy. https://pxhere.com/en/photographer/4051010. AD&D insurance only pays if you're wounded or eliminated in a crash, whereas life insurance pays out for many causes of death. As a result of this, AD&D isn't ideal for every person, yet it might be beneficial if you have a risky occupation.Pro: Price whether it's offered as a benefit with your company or you get it by yourself, plans are usually inexpensive. Disadvantage: Restricted insurance coverage AD&D covers you only under specific conditions, whereas a standard life insurance coverage policy offers a lot more detailed protection. Joint life insurance policy is a life insurance coverage plan that covers two people.

The majority of joint life insurance plans are permanent life insurance policy policies, which last your entire life and have an investment-like money worth attribute that gains rate of interest. Final Expense in Toccoa, GA. Joint term life insurance coverage plans, which expire after a collection duration, do exist but are much less usual. Pro: Convenience joint policies can cover two people if among them does not receive insurance coverage, or if getting 2 separate plans is out of budget plan.

Best for: Couples who do not receive two specific life insurance policy plans. There are 2 main kinds of joint life insurance policy policies: First-to-die: The policy pays out after the initial of both spouses dies. First-to-die is the most comparable to a private life insurance coverage policy. It helps the enduring policyholder cover costs after the loss of financial backing.

The Only Guide for Thomas Insurance Advisors

Second-to-die life insurance policy, generally called a survivorship plan, functions best as a windfall to a reliant. It doesn't provide any income replacement for your companion if you pass away before they do. A short-term life insurance policy plan gives some coverage while you're waiting to obtain a longer-term plan. Plans last a year or much less and shield you if you can not get budget-friendly costs due to a present health problem or you're awaiting your insurance firm to find to a choice on your application.

No-medical-exam life insurance policy typically describes term life policies that don't call for the test, however various other sorts of insurance coverage, like streamlined problem, do not require the test, either. These kinds of plans additionally include much shorter waiting durations, which is the void in between the minute you start the application process and the moment your policy ends up being reliable.

Pro: Time-saving no-medical-exam life insurance offers quicker access to life insurance coverage without having to take the clinical test., additionally recognized as volunteer or voluntary extra life insurance policy, can be made use of to bridge the coverage gap left by an employer-paid group plan.

Everything about Thomas Insurance Advisors

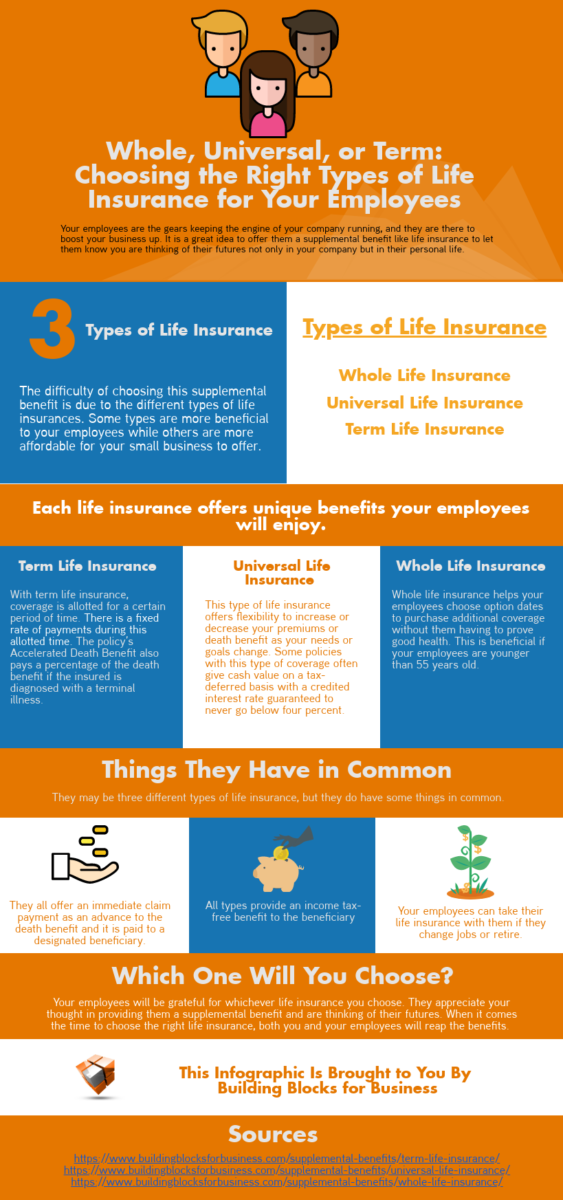

You'll generally experience additional life insurance policy as an click this site optional employee benefit used in enhancement to your basic group life insurance policy, yet not all employers use this advantage. Supplemental plans are generally gotten via your employer but can be bought independently. If you acquire this sort of policy via your company, you might lose it if you leave the business.

Pro: Convenience guaranteed accessibility to additional coverage when used as an advantage by a company., a kind of simplified issue life insurance, provides a little quantity of irreversible life insurance coverage to those who don't qualify for various other plans, and also it does not need a medical test.

Pro: Ease streamlined concern plans provide little protection quantities for last expenses without having to take the medical exam. Con: Expense higher costs for a reduced insurance coverage quantity.

Our Thomas Insurance Advisors PDFs

:max_bytes(150000):strip_icc()/how-does-insurance-sector-work.asp-FINAL-1ccff64db9f84b479921c47c008b08c6.png)

Comments on “The Main Principles Of Thomas Insurance Advisors”